🔴 Website 👉 https://u-s-news.com/

Telegram 👉 https://t.me/usnewscom_channel

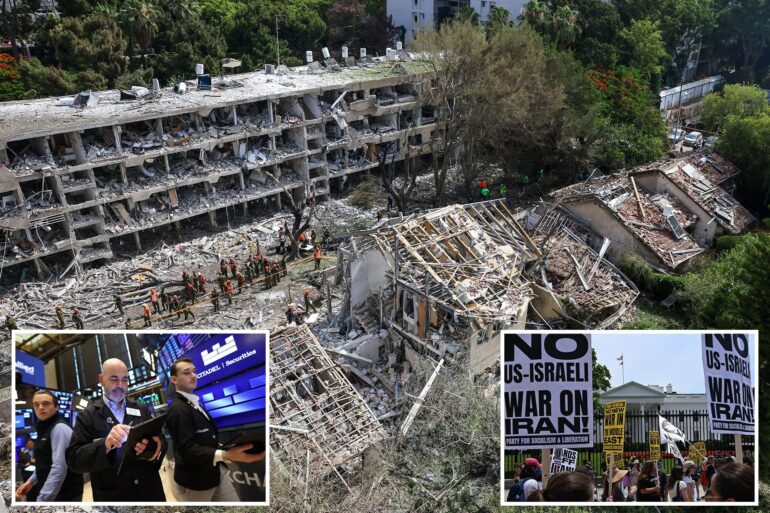

US stocks shrugged off geopolitical jitters following the US strike on Iranian nuclear sites.

Oil prices were slightly higher after a weekend jump, while cryptocurrencies rose.

The Dow was recenty up 102 points, or 0.24%, to 42,309.57 as of 9:57 a.m. EDT, while the S&P 500 was up 0.3% at 5,985.98. The Nasdaq was up 39.07, or 0.2% at 19,486.48.

Traders continue to monitor tensions in the Middle East following the US B-2 bomber assault on Iran’s nuclear facilities, including Fordow, Natanz and Isfahan.

Following the airstrikes, Tehran’s parliament has backed a resolution to potentially shut the Strait of Hormuz, one of the world’s most vital energy arteries.

While the move requires final approval from Iran’s Supreme National Security Council, the symbolic step has rattled global markets and sparked international concern.

“With Saturday night’s US B-2 bombing of key Iranian nuclear facilities including Fordow, Natanz, and Isfahan the key question hearing from investors over the weekend is what does this mean for the markets looking at trading today and this week,” wrote Dan Ives, managing director at Wedbush Securities.

“Our initial take speaking with tech investors around the globe over the weekend….it was viewed this US strike was a matter of when, not if the US was going to do this B-2 attack and in turn this ultimately removes an overhang on the market in our view after this successful strike.”

Ives said he expects tech stocks to remain resilient and sees cybersecurity companies as a bright spot in the short term.

“We believe tech stocks should shake this Iran jitters off with cyber security stocks in particular set to be front and center this week as investors anticipate some cyber attacks from Iran could be on the horizon as retaliation.”

Oil prices climbed on Monday as traders assessed whether Iranian retaliation could disrupt supplies. West Texas Intermediate crude rose $0.64, or 0.87%, to $74.48, while Brent crude climbed 0.70% to $77.55. Natural gas was up 0.18%, RBOB gasoline jumped nearly 1%, and ultra-low sulfur diesel added 0.26%.

“Seeing oil rise to $100 per barrel in the near-term is unlikely, but not out of the question,” Ives warned in a separate note, pointing to risks around the Strait of Hormuz.

In crypto markets, digital assets staged a broad rally. Bitcoin surged 2.32% to $101,384.61, while Ether jumped 3.27% to $2,255.90. Solana rose 4.18%, Dogecoin added 2.87%, and XRP was up 2.18%.

Ives said the broader market is likely to view the Iran threat as receding after the strike.

“Furthermore a weakened Iran with no nuclear capacity removes the biggest threat to the Middle East and Israel which will be viewed as a positive for the market and tech stocks in particular as investors digest this news,” he wrote.

Ives added that investors are optimistic about the region’s longer-term economic and tech potential.

“With a weakened Iran and no nuclear capabilities, there is a growing view from tech investors that the opportunity for the Middle East to embrace the tech and AI boom is now on the doorstep being led by Saudi and UAE,” Ives wrote.

He acknowledged that volatility may persist in the near term, but called it a buying opportunity.

“There could naturally be some more volatility and headline risk this week….but we would encourage investors to buy our tech winners and AI Revolution stalwarts such as Nvidia, Palantir, Microsoft, Amazon, Oracle, Tesla on any weakness from geopolitical headlines,” Ives wrote.

“On the cyber security sector, our favorite names remain Palo Alto, Cyberark, Crowdstrike, Zscaler and Checkpoint.”