🔴 Website 👉 https://u-s-news.com/

Telegram 👉 https://t.me/usnewscom_channel

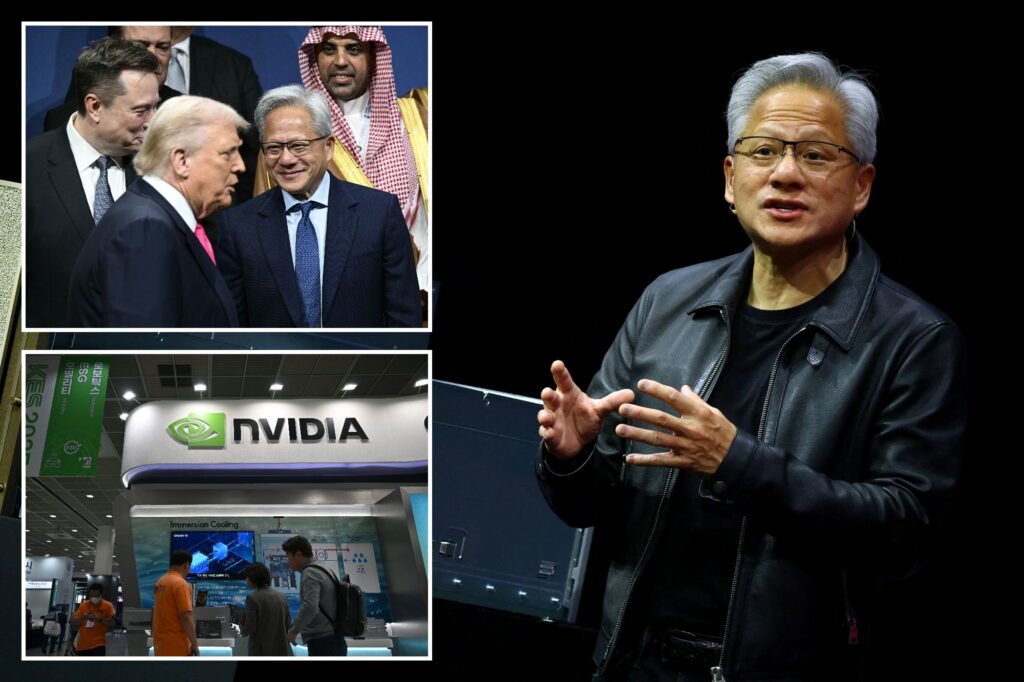

Nvidia CEO Jensen Huang touted “off the charts” demand for its advanced computer chips as the tech titan reported strong third-quarter results on Wednesday – a major relief for investors who have fretted about a potential AI bubble.

The AI chip giant also provided strong fourth-quarter guidance, indicating it expects sales of $65 billion – higher than the $61.66 billion predicted on Wall Street, according to LSEG data.

The results were expected to steady markets, which were wobbly in recent days over concerns that tech stocks are overvalued and AI companies have overspent on the fledging technology, with little revenue to show for it.

“Blackwell sales are off the charts, and cloud GPUs are sold out,” Huang said in a statement, referring to Nvidia’s most advanced chips.

“The AI ecosystem is scaling fast — with more new foundation model makers, more AI startups, across more industries, and in more countries. AI is going everywhere, doing everything, all at once.”

Nvidia shares surged 4% in after-hours trading on the strong results.

Its performance is seen as a crucial bellwether since the tech industry’s biggest players – including OpenAI, Amazon, Microsoft, Google and Meta – rely on Nvidia’s chips to power their data centers and AI models.

“Nvidia earnings are such an important event both because of the weighting that the stock has in the major equity indices and because it is ground zero for the entire artificial intelligence build out,” said Chris Zaccarelli, chief investment officer at Northlight Asset Management.

In the third quarter, Nvidia posted earnings of $1.30 per share, besting the $1.25 estimated by analysts. The company’s overall revenue was $57.01 billion, which also came in ahead of expectations and was up 22% compared to the same quarter one year ago.

The company’s data center unit, which provides the bulk of its revenue, booked sales of $51.2 billion for the quarter.

Looking ahead, Nvidia said it expects an adjusted gross margin of 75% in the current quarter, which was slightly ahead of an expected 74.5%.

Last month, Huang said Nvidia already has $500 billion in chip deals on the books through 2026.

Nevertheless, fears about Nvidia’s outlook mounted in the days ahead of its earnings release after Japanese investment giant Softbank and billionaire tech investor Peter Thiel each dumped all of their stakes in the company. That jumpstarted concerns that Nvidia shares were overvalued.

Wedbush analyst Dan Ives, known for his bullish views on the AI sector, said Nvidia’s results should “reignite the bullish tech trade into year-end.”

“Fears of an AI Bubble are way overstated in our view … this is another validation point for the AI revolution and our view we are in the top of the third inning of this AI game,” Ives added.