🔴 Website 👉 https://u-s-news.com/

Telegram 👉 https://t.me/usnewscom_channel

California billionaires are leaving the state in record numbers, and taking their billions with them. According to one billionaire, more than $1 Trillion has already left.

California Governor Gavin Newsom, Democrats and the SEIU are pushing a retroactive billionaire tax targeting the roughly 220 billionaires residing in California in 2025, ignoring that these individuals are the most financially mobile and can live anywhere. Expecting them to remain in the state as if they will happily and willingly hand over even more of their wealth surely must be facetious, the Globe reported.

SEIU is sponsoring the “2026 Billionaires Tax Act.” The measure, recently listed on the Attorney General’s website, would impose a one-time 5% tax on individual wealth exceeding $1 billion. Gov. Newsom was all for the tax until he saw that billionaires were already leaving the state taking $1 trillion of their wealth with them, before the initiative even qualified for the ballot.

The Globe recently reported Jan 12th:

Chamath Palihapitiya posted to X yesterday:

Unfortunate update as of today: More calls from friends. The total wealth that has left California is now $1T. We had $2T of billionaire wealth just a few weeks ago. Now, 50% of that wealth has left – taking their income tax revenue, sales tax revenue, real estate tax revenue and all their staffs (and their salaries and income taxes) with them.

Despite the exodus of the billionaires, the left is all-in on the tax. Here is how the SEIU characterizes the billionaire tax – “to prevent the state’s healthcare system from collapsing:”

“…a new ballot initiative was recently announced that will enact a one-time, emergency 5% tax on California billionaires to prevent the state’s healthcare system from collapsing — and to protect more than 4 million California businesses from facing steep increases to insurance premiums that could lead to mass layoffs across multiple industries. This proposal represents a dollar-for-dollar solution to replace the federal funding that recent cuts have stripped from Medi-Cal.”

Nowhere in the email do they specify that it’s California’s Medi-Cal low-income subsidized health system that is about to collapse, not do they explain why.

Governor Gavin Newsom and the state’s Democrats created the collapse of Medi-Cal by giving free healthcare to every illegal immigrant illegally living in the state. This is not rumor. The Globe has covered this saga for some time now.

Gavin Newsom’s Medi-Cal program for low-income Californians is insolvent because he gifted free Medi-Cal coverage to every illegal immigrant in the state, costing taxpayers $23 billion over 2 years, forcing Newsom to get both an emergency loan and a bailout, Rep. Kevin Kiley confirmed in September.

BUT TRUMP!

Predictably, the leftist SEIU claims the real problem is “Federal Medicaid cuts included in HR1, projected to strip roughly $100 billion from California healthcare over the next five years—pushing the state toward a healthcare collapse that will force hospitals and ERs to close, insurance premiums to skyrocket, and tens of thousands of healthcare jobs to vanish.”

“Without replacement funding, experts warn that California could lose as many as 145,000 healthcare jobs statewide.”

Remember, it’s the SEIU behind the billionaire tax, so of course they care about union health jobs, rather than health care.

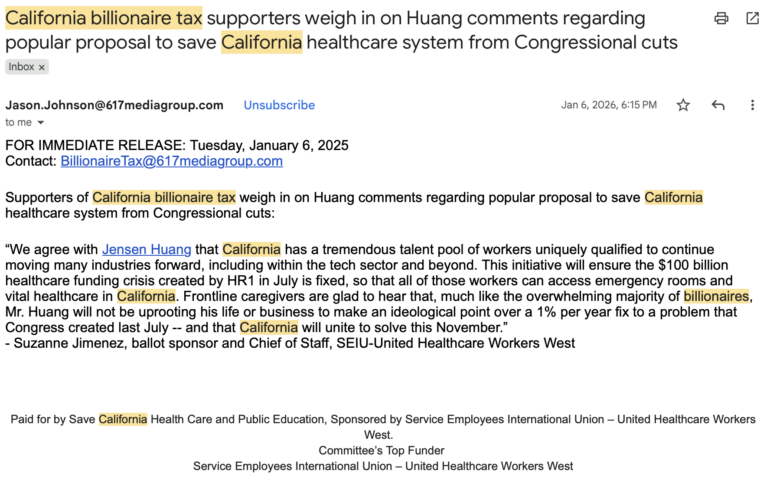

All of this information is “Paid for by Save California Health Care and Public Education, Sponsored by Service Employees International Union – United Healthcare Workers West. Committee’s Top Funder – Service Employees International Union – United Healthcare Workers West.”

I received an email from the PR team for the SEIU stating, “Supporters of California billionaire tax weigh in on Billionaire Nvidia CEO Jensen Huang comments regarding popular proposal to save California healthcare system from Congressional cuts.”

According to Forbes, Billionaire Nvidia CEO Jensen Huang said he was “perfectly fine” with California’s proposed tax on billionaires, sharply breaking with fellow Silicon Valley tech executives who have criticized the proposal and threatened to leave the state. In an interview with Bloomberg Television on Tuesday, Huang said he ‘hadn’t thought about it even once,’ noting that even though his company has offices in multiple countries, ‘we work in Silicon Valley because that’s where the talent pool is.’”

“We agree with Jensen Huang that California has a tremendous talent pool of workers uniquely qualified to continue moving many industries forward, including within the tech sector and beyond. This initiative will ensure the $100 billion healthcare funding crisis created by HR1 in July is fixed, so that all of those workers can access emergency rooms and vital healthcare in California. Frontline caregivers are glad to hear that, much like the overwhelming majority of billionaires, Mr. Huang will not be uprooting his life or business to make an ideological point over a 1% per year fix to a problem that Congress created last July — and that California will unite to solve this November.”

– Suzanne Jimenez, ballot sponsor and Chief of Staff, SEIU-United Healthcare Workers West

The SEIU disingenuously claims that the billionaire tax is a “one-time emergency tax” that “would be paid only by Californians worth more than $1 billion—roughly 200 individuals who collectively hold over $1 trillion in wealth, most of which will never be taxed in their lifetimes due to state and federal loopholes.”

If billionaires are already leaving the state and taking their trillion$ with them, they obviously don’t believe that this is a one-time tax.

California’s wealth tax is theft, according to President Trump’s AI and crypto czar:

“This is not a tax — this is asset seizure,” said billionaire venture capitalist David Sacks to CNBC’s “Squawk Box.” Sacks insisted that “it’s not a one-time, it’s a first time.”

“And if they get away with it, there’ll be a second time and a third time. And this will be the beginning of something new and different in this country, which is asset seizure,” he said.

Sacks, who has relocated to Texas after three decades in California, believes the legislation has a “good chance” of passing and could set a precedent for similar bills in other states.

He called out Gov. Gavin Newsom for his delayed opposition to the bill, which he argued has caused a trillion dollars of net worth to leave the state and put a “huge hole” in tax collections.

The billionaire tax on assets is double taxation, as the assets were taxed at the time of purchase – cars, designer furniture, second homes, rare art, etc…

In 2023, we asked Why Did 352 California Companies Flee to Other States in Three Years? Here’s why: Low-to-no income tax states gained $391 billion from California during 2018 to 2021, coinciding with Gavin Newsom’s election as governor.

Gird your loins for a gross disinformation campaign, and arm yourself with the facts. It’s not about healthcare at all.

This content is courtesy of, and owned and copyrighted by, https://californiaglobe.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.