🔴 Website 👉 https://u-s-news.com/

Telegram 👉 https://t.me/usnewscom_channel

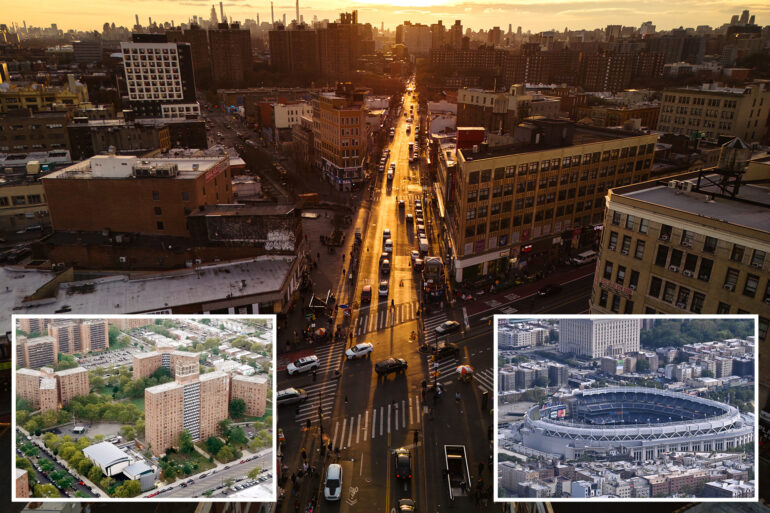

During the 1977 World Series, fires outside Yankee Stadium prompted broadcaster Howard Cosell to make his famous announcement: “Ladies and gentleman, The Bronx is Burning.”

That encapsulated the decline of New York City in a single phrase.

Yet just a few years earlier, there was clear evidence of the city’s decline in the financial situation of rent-regulated buildings.

Years of capped rents coupled with rising operating costs due to high inflation led to buildings with revenue that didn’t cover expenses.

Building owners were forced to choose between paying for fuel to heat their buildings or property taxes.

Because owners picked fuel, the city’s budget suffered, contributing to the government’s plummet into bankruptcy.

Data released last week by the Rent Guidelines Board paints a picture eerily similar to what was happening in The Bronx before that day in 1977.

The RGB report, which looked at 2023 data, showed that pre-1974 buildings in The Bronx are in severe distress.

More than 12% had operating costs that exceeded the building’s income, even before they paid the mortgage or did mandatory improvements like Local Law 97 compliance.

When you factor those things into the calculation, the majority of these older buildings are operating in the red.

This is in line with various news reports about increased bankruptcy filings and buildings selling at ridiculous discounts of 70% or more. One building sold at a shocking 97% discount.

Overall, the number of older, rent-stabilized buildings failing to pay their mortgages shot up significantly in 2024.

In one case, a building owner is actually suing a bank because the bank refuses to take the building off the owners’ hands as part of the foreclosure process.

You read that right: The bank doesn’t want to take possession of the building because it knows know it’s losing money.

Buildings that are operating at a loss have no access to additional financing for emergency maintenance or mandatory improvements.

Banks look at the potential for a building to repay a loan, and won’t extend a line of credit to a building that can’t clearly show that this is possible.

The unfortunate outcome of a building that has been defunded and is now functionally bankrupt is an increase in violations.

This comes from lack of money to do repairs, forced staff cuts and other disinvestment.

And when a building doesn’t have the income to properly operate, the renters are the ones that suffer.

Government is making things worse, not better. Costly new mandates, like forcing building supers to pick through tenants’ trash to ensure proper composting or pay fines, add up and accelerate the decline in the quality of housing for hundreds of thousands of New Yorkers.

Our analysis shows that conditions in 2024 grew even worse for the majority of rent-stabilized buildings, which reside outside of the wealthiest parts of Manhattan.

Insurance premiums have shot up at an alarming rate; water and sewer costs are up more than 10%; fuel prices continue to rise — and even though most buildings have declining values, the city still raises their property taxes each year.

The Bronx doesn’t have to burn. There is still time to reverse this trend.

Three things must happen:

* First, the Rent Guidelines Board needs to adjust rents above inflation, to make up for the past decade of below-inflation increases.

* Second, the government needs to figure out a way to provide a tax break or other subsidy to the buildings that are in deep distress. According to the RGB data, 20% of pre-1974 buildings had no income or negative income in 2023 — yet still had to pay taxes.

* Third, we need a more sustainable system going forward. This requires a hard look at the current regulations and adjustments to make sure buildings that are close to 100% stabilized can survive.

I’m a Bronx native, and I’m raising my family here. I don’t want to see my borough repeat the afflictions of the past.

But when I see so many homes near bankruptcy, or already in the foreclosure process, it’s hard to be hopeful.

Kenny Burgos is the CEO of the New York Apartment Association and a former assemblyman from The Bronx.