🔴 Website 👉 https://u-s-news.com/

Telegram 👉 https://t.me/usnewscom_channel

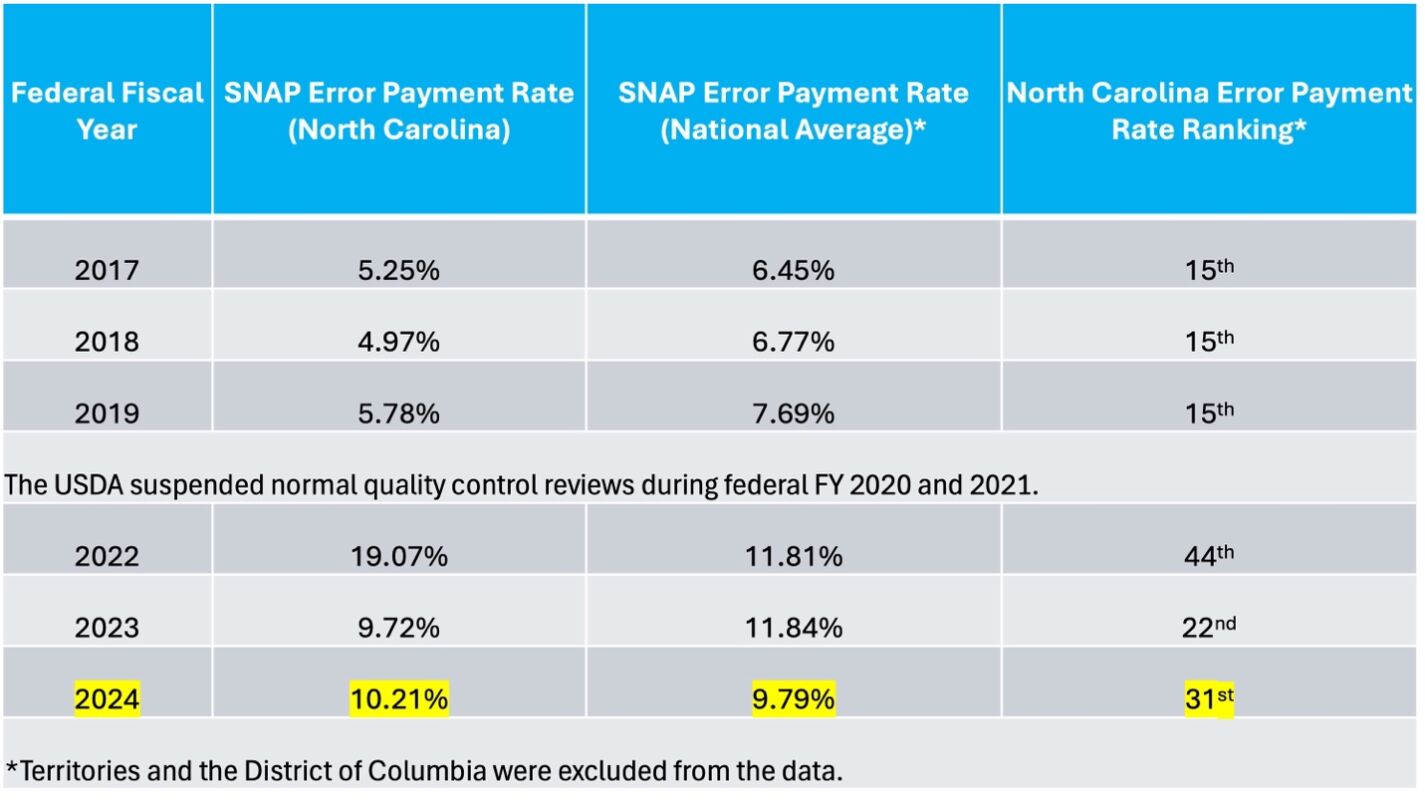

The One Big Beautiful Bill (OBBB) introduces fiscal consequences for states with payment error rates in the Supplemental Nutrition Assistance Program (SNAP) of 6 percent or greater starting in federal fiscal year (FY) 2027–28. Concerningly, in federal FY 2023–24, the SNAP payment error rate in North Carolina exceeded 10 percent, which under the OBBB would have cost state taxpayers approximately $450 million.

SNAP

SNAP, initially created as the Food Stamp Program in 1964, was established to subsidize the purchase of groceries for low-income Americans. The program is administered at the state level. Yet, the federal government fully funds the cost to provide benefits, which means states bear no financial loss from poorly administering the program.

In particular, the problem intensified during COVID-19, when federal waivers relaxed verification requirements and paused quality control reviews. State agencies became accustomed to approving cases quickly with minimal documentation and failed to reinstate rigorous oversight when the pandemic ended. This allowed ineligible households to enroll and fueled a surge in payment errors once reviews resumed.

The payment error rate measures the percentage of total SNAP benefit dollars issued in the wrong amount, whether by giving an eligible household more than they should receive, giving them less, or paying benefits to a household that is not eligible at all.

The data show North Carolina’s SNAP payment error rate has climbed sharply since federal quality control reviews resumed after COVID-19. While the state’s rate was consistently below the national average from federal FY 2016–17 to FY 2018–19, it spiked to 19.07 percent in federal FY 2021–22 — far above the national average of 11.81 percent. Despite some improvements, the error rate has remained elevated, ranking North Carolina 31st among states (30 states had a lower error rate) in federal FY 2023–24.

OBBB

The OBBB aims to remedy the surge in payment errors and hold states fiscally accountable for poor program management by implementing cost-sharing requirements for states with unsatisfactory performance.

Under the updated OBBB rules taking effect in federal FY 2027–28, states with a SNAP payment error rate below 6 percent will continue to have the federal government cover 100 percent of benefit costs.

However, if the error rate is at least 6 percent but less than 8 percent, the state will have to pay 5 percent of SNAP’s benefit costs; at least 8 percent but less than 10 percent, the state’s share rises to 10 percent. Any state with an error rate of 10 percent or higher will be responsible for 15 percent of benefit costs — a penalty amounting to hundreds of millions of dollars in North Carolina if the current error rate persists.

Fiscal consequences

If the OBBB funding match rules had been in place in federal FY 2023–24, North Carolina’s 10.21 percent payment error rate would have triggered the maximum penalty. With SNAP benefits to North Carolina households totaling roughly $3 billion that year, the state would have been responsible for covering 15 percent of those costs, or about $450 million.

By federal FY 2027–28, SNAP benefit levels will likely be even higher, meaning the penalties for high error rates will also grow larger. This creates an ongoing fiscal risk that could hit North Carolina in any given year if the state bureaucracy fails to keep error rates under control. Because these penalties will depend on annual performance, they could be difficult to predict or budget for, potentially forcing last-minute tax hikes or emergency spending cuts.

Closing thoughts

Legislators should see this as a clear warning. Unless oversight improves and payment error rates fall below the OBBB threshold, North Carolina taxpayers will be left footing a bill that could easily run into the hundreds of millions. The state should invest in artificial intelligence to assist caseworkers in identifying inconsistencies between SNAP applications and wage, tax, or residency records in real time and utilize predictive analytics to identify high-risk cases for targeted audits.

The choice is simple — either fix the system now or pay the price later.

The post Oh, SNAP! Bureaucratic errors could cost state taxpayers hundreds of millions first appeared on John Locke Foundation.

This content is courtesy of, and owned and copyrighted by, https://www.johnlocke.org and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.