🔴 Website 👉 https://u-s-news.com/

Telegram 👉 https://t.me/usnewscom_channel

OAN Staff Brooke Mallory

5:37 PM – Wednesday, September 17, 2025

The Federal Reserve announced a quarter-point reduction in its key interest rate on Tuesday, lowering it to a range of 4.00% to 4.25%. This marks the first rate cut since December of last year.

Alongside the cut, the Fed signaled plans for two additional rate reductions later this year, potentially bringing the rate down to a range of 3.50% to 3.75%.

The central bank indicated this more accommodative stance is aimed at supporting economic growth.

Advertisement

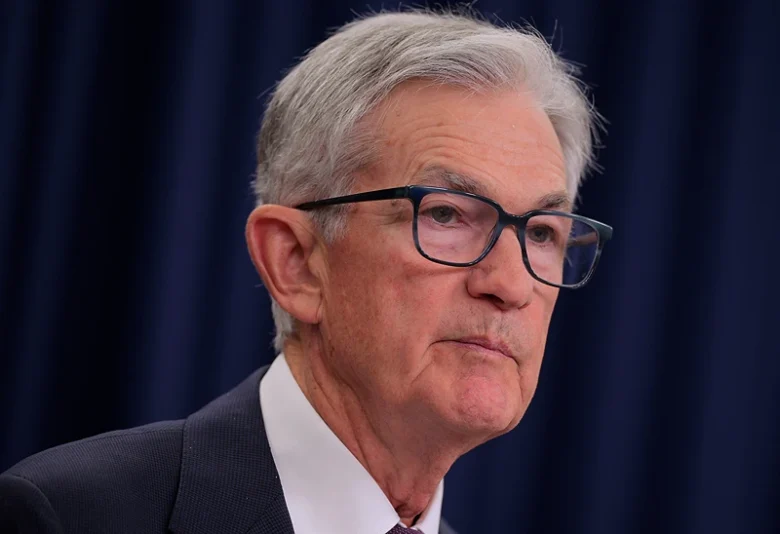

Following the announcement, the S&P 500 initially rose 0.5% but retreated to close down 0.2% as Fed Chair Jerome Powell addressed the press.

Major tech stocks experienced declines as well, with Nvidia (NVDA) down 1.3%, Uber (UBER) falling 0.9%, and Tesla (TSLA) slipping 2.1%.

“Markets had largely priced in a rate cut, but investors will be watching carefully for guidance on future easing,” said Jane Doe, chief economist at XYZ Bank.

Globally, European and Asian markets reacted cautiously, reflecting concerns about slower growth in the U.S. and its potential ripple effects abroad.

Meanwhile, the move aligns with Wall Street expectations for continued monetary easing, and investors will be closely monitoring upcoming economic data — particularly inflation and employment reports — to gauge the trajectory of future rate cuts.

Historically, the Fed’s current target range remains well below the peak levels seen in recent years.

Stay informed! Receive breaking news blasts directly to your inbox for free. Subscribe here. https://www.oann.com/alerts

What do YOU think? Click here to jump to the comments!

Sponsored Content Below