🔴 Website 👉 https://u-s-news.com/

Telegram 👉 https://t.me/usnewscom_channel

NOTE: nothing in this article shall be deemed as provided personalized financial advice, legal advice, tax advice or any other advice of any kind. You should consult with your personal legal, tax and financial advisors to determine what is best for your personal situation.This is absolutely incredible!

If you don’t run a small business (or a business of any kind) you may not have been aware of this, but the Biden Regime put into place a new federal law called the Corporate Transparency Act.

In essence, it was just one more way for the Federal Government to get involved in your private affairs, demanding that you disclose ownership of everyone in your company to the Federal Government and provide all sorts of invasive details, all via a filing called the “Beneficial Ownership Information” or BOI for short.

And failure to comply comes with STEEP penalties, $500/day for each day you fail to comply, plus another $10,000 fine on top of that, plus up to two years in prison on top of that!

Key Provisions of the CTA:

Beneficial Ownership Reporting

- Businesses must report individuals who own or control at least 25% of the company or exert significant control over it.

- Report includes full name, date of birth, address, and a unique identifying number (e.g., passport or driver’s license).

Who Must Report?

- Most small and medium-sized businesses formed in the U.S. or registered to do business in the U.S.

- Exceptions include larger companies (with more than 20 full-time employees and over $5 million in revenue) and certain regulated industries (e.g., banks, investment firms).

Reporting Deadlines:

- Companies formed before Jan. 1, 2024 must file by Jan. 1, 2025.

- New businesses formed in 2024 have 90 days from registration.

- New businesses formed after 2024 have 30 days to report.

Penalties for Non-Compliance:

- Fines up to $500 per day for failure to report.

- Criminal penalties including fines up to $10,000 and up to 2 years in prison for willfully providing false information

If all of that sounds like an illegal search and seizure in violation of the 4th Amendment, as well as violations of a host of other things like due process, you would not be incorrect.

Luckily, the Trump Administration is fixing yet another mistake (or perhaps a better word is “intentional bomb”) left by the Biden Regime.

The official US Treasury Department account on Twitter just made the announcement that the BOI reporting requirement is DEAD.

I am standing here applauding as I type this!

BRAVO!

As a first step, the Treasury has announced it will not enforce any fines or penalties for non-compliance:

The Treasury Department is announcing today that, with respect to the Corporate Transparency Act, not only will it not enforce any penalties or fines associated with the beneficial ownership information reporting rule under the existing regulatory deadlines…

— Treasury Department (@USTreasury) March 2, 2025

It will then seek to narrow the requirement to apply to FOREIGN companies only:

…but it will further not enforce any penalties or fines against U.S. citizens or domestic reporting companies or their beneficial owners after the forthcoming rule changes take effect either.

— Treasury Department (@USTreasury) March 2, 2025

The Treasury Department will further be issuing a proposed rulemaking that will narrow the scope of the rule to foreign reporting companies only.

— Treasury Department (@USTreasury) March 2, 2025

Treasury takes this step in the interest of supporting hard-working American taxpayers and small businesses and ensuring that the rule is appropriately tailored to advance the public interest.

— Treasury Department (@USTreasury) March 2, 2025

Treasury Secretary Scott Bessent called it a victory for common sense:

“This is a victory for common sense,”said US Treasury @SecScottBessent “Today’s action is part of President Trump’s bold agenda to unleash American prosperity by reining in burdensome regulations, in particular for small businesses that are the backbone of the American economy.”

— Treasury Department (@USTreasury) March 2, 2025

It’s possible that Elon Musk may be to thank for getting the ball rolling on this, as the news comes just two days after someone tagged Elon on X about this and Musk responded that he can look into it:

And just like that, it’s gone!

Thank you @elonmusk and @w_terrence pic.twitter.com/hboOWznN3T

— Publius (@OcrazioCornPop) March 3, 2025

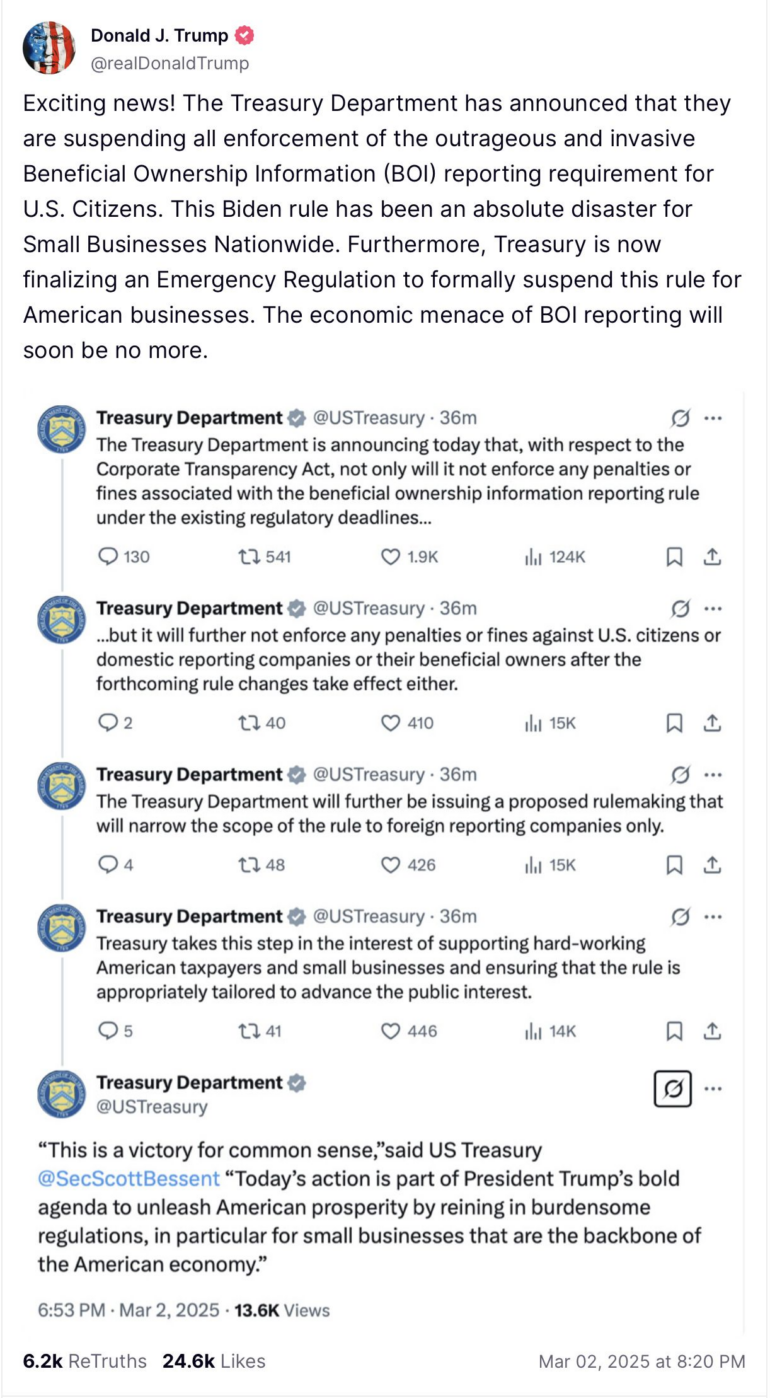

And to give added confirmation that the BOI nonsense is truly dead, President Trump himself posted the Treasury Department Tweets to TruthSocial along with this message:

FULL TEXT:

Exciting news! The Treasury Department has announced that they are suspending all enforcement of the outrageous and invasive Beneficial Ownership Information (BOI) reporting requirement for U.S. Citizens. This Biden rule has been an absolute disaster for Small Businesses Nationwide. Furthermore, Treasury is now finalizing an Emergency Regulation to formally suspend this rule for American businesses. The economic menace of BOI reporting will soon be no more.

Here’s even more, from the AP:

The U.S. Treasury Department announced it will not enforce a Biden-era small business rule intended to curb money laundering and shell company formation.

In a Sunday evening announcement, Treasury said in a news release that it will not impose penalties now or in the future if companies fail to register for the agency’s beneficial ownership information database that was created during the Biden administration.

Despite efforts by small businesses to undue the rule in the courts, it remains in effect.

On Sunday, President Donald Trump on his Truth Social media site praised the suspension of enforcement of the rule and said the database is “outrageous and invasive.”

“This Biden rule has been an absolute disaster for Small Businesses Nationwide,” he said. “The economic menace of BOI reporting will soon be no more.”

In September 2022, the Treasury Department started rulemaking to create a database that would contain personal information on the owners of at least 32 million U.S. businesses as part of an effort to combat shell company formations and illicit finance.

The rule required most American businesses with fewer than 20 employees to register their business owners with the government as of Jan. 1, 2024. Small businesses are targeted because shell companies, often used to hide illegally obtained assets, tend to have few employees.

Treasury officials, including former Treasury Secretary Janet Yellen, said the regulatory burden would be small, costing about $85 per business, but would offer benefits to law enforcement officials seeking to track down money launderers and other criminals. She said in January 2024 that more than 100,000 businesses had filed beneficial ownership information with Treasury.

The rule and its legislative authority — the Corporate Transparency Act, an anti-money laundering statue passed in 2021 — have been mired in litigation. In 2022, a small business lobbying group sued to block the Treasury Department’s requirement that tens of millions of small businesses register with the government. On Feb. 27, Treasury’s Financial Crimes and Enforcement Network said it would not take enforcement actions against companies that do not file beneficial ownership data with the agency.

Congratulations to all the legends out there who held out and did not file this form!

I salute you!

And a big thank you to President Trump, Scott Bessent and Elon Musk for getting this fixed so quickly.

NOTE: nothing in this article shall be deemed as provided personalized financial advice, legal advice, tax advice or any other advice of any kind. You should consult with your personal legal, tax and financial advisors to determine what is best for your personal situation.

This is a Guest Post from our friends over at WLTReport.